Find Your Trading Opportunities for Stocks, Options, Futures, Forex

Long-Term Investor Alert Update.

If trading was easy, nobody would ever go to work!

Trading requires you to handle a high amount of complexity in finding securities with potential price moves, making the decision to trade them with an adequate strategy at defined entries and exits.

As a subscriber, we help you identifying assets on a potential institutional initiated price move for day trading, swing trading and long-term investing.

Imagine all the hours you need to spend for selecting the opportunities we deliver into your inbox.

Find the alert that suits you best:

- Day Trading Alert

- Stock Trading Alert (Swing Trading)

- Long-Term Investor Alert

In this publication, we focus on the “NLT Long-Term Investor Alert” which includes:

- Industry sector development overview.

- Power options.

- Futures and Forex in focus.

- Selected stocks with options.

Developing the “NLT Long-Term Investor Alert”, we are included the following:

- A filter for stocks with lower-price-move-expectation and unfavorable option stats; keeping our focus on stocks with favorable returns, and easy adjustment possibilities.

- A first round of chart evaluation, where unfavorable setups are sorted out and the list of symbols is reduced.

- Approximation of the Reward/Risk setups: Risky, acceptable, and favorable. Chart evaluation required.

- Indication of Put/Call sentiments: Bullish- (green) or bearish (red).

- A stock market segment sentiment bar chart, plotting the relation of favorable up- and downside movers.

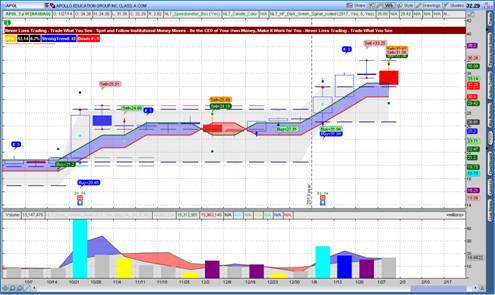

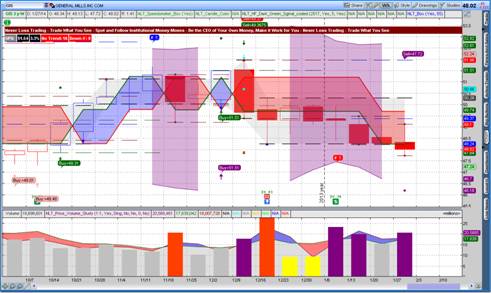

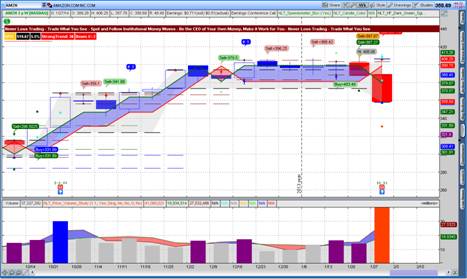

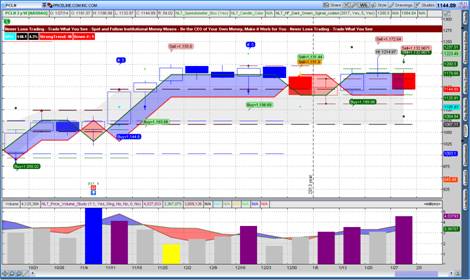

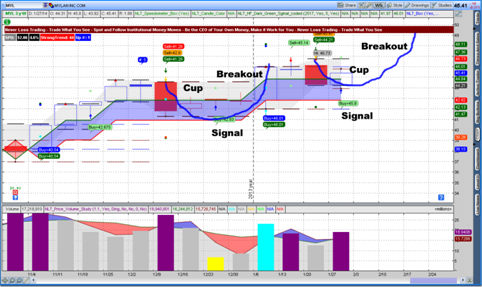

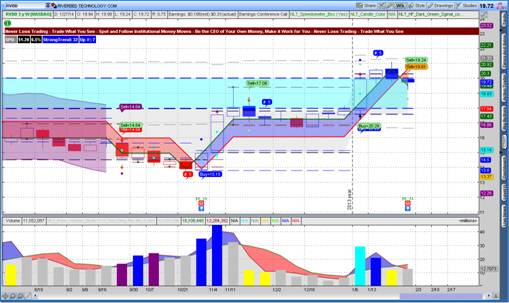

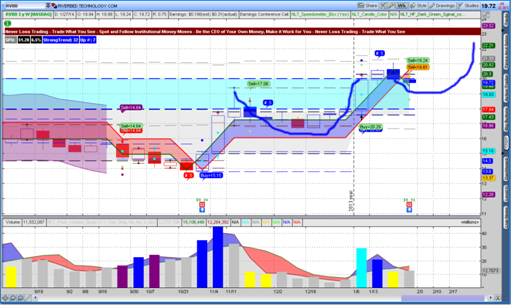

- Price Pattern Evaluation: Explaining the price situation where the NLT signal occurred. All NLT signals need confirmation by the candle, which follows the trade initiation candle, surpassing the set price threshold Buy > $39.29 e.g. This week’s examples are:

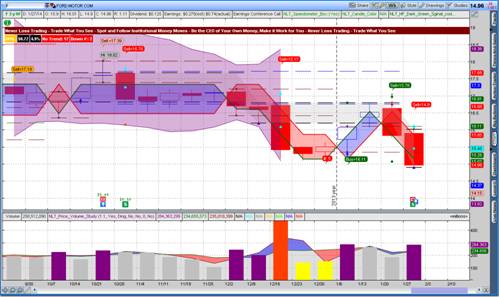

- Hi Earnings Breakdown: The stock price broke down even so 20% higher than expected earnings were reported: Bearing a reversal- or further breakdown potential. Please see the Ford example:

- Mid-Range Reversal: Price position between high and low with a momentum change.

- Range Breakdown: The stock price breaks a major support level.

- Upside Change in Command (CiC): After strong buying/selling and opposite NLT Light Tower shows institutional engagement.

- Lo Earnings Breakdown: Prices drop after lower than expected earnings.

- Top Weakness: Potential top breakdown.

- Breakdown Potential: Downside price move indicated.

- Bullish Cup: Upside breakout pattern indicated.

- Bottom Reversal: Institutional engagement indicated at a low price level.

- Hi Earnings Upside: Upside price move after better than expected earnings.

- New High: Stock price is at a new high.

- Up Move Follow-Through: Continuation pattern.

- NLT Signal Setup Potentials explained in a separate worksheet.

To further reduce your watch-list, select the ones best fitting your trading strategy per industry segment:

- Power Tower: Expect a 1-SPU continuation move when you have a trade initiation candle at the bottom of a NLT Double Decker color change. Be careful with NLT Light Towers at the top of a range or at the second or third NLT Light Tower in the trend move: Consider a reversal potential.

- End Purple Zone: 1-SPU focus move.

- HF-Signal: Pre-Stage of a stronger potential directional move > 1-SPU.

- Vol. Diff Signal: ½-SPU on continuation pattern moves.

- Early Trend or Top and Bottom Signals: Potential strong directional move with little risk.

Applying the NLT-Delta-Force-Concept as an option trader, please consider our price indications for longer-term positions, which you find in the last four columns of the stock report.

“Never be late for a Trade: NeverLossTrading Alerts”

Find the Alert that suits you and receive it free for one week:

http://neverlosstrading.com/Alerts.html

Learn NeverLossTrading: Call +1 866 455 4520 or contact@NeverLossTrading.com

Featured Trades

All information provided is based on the algorithms, and indicators used in NeverLossTrading and does not represent trade or investment proposals. Please read the details of the Disclaimer and Subscriber Agreement.

Disclaimer

The risk of trading securities, options, and futures can be substantial. Customers must consider all relevant risk factors, including their own personal financial situation before trading. In our teaching of how to trade the markets, in our newsletters, webinars and our involvement in the Investment Clubs, neither NOBEL Living, LLC, the parent company of NeverLossTrading® , or any of the speakers, staff or members act as stockbrokers, broker dealers, or registered investment advisers. We worked out trading concepts and share them through education with our members and clients.

US Stock Market Holiday Schedule:

US Stock Market Holiday Schedule: