NLT SwingPower Trading Concept

The NLT SwingPower Indicator lives up to its name by directly uncovering lucrative swing trading opportunities. We adhere to a principle of trading based on visual cues, allowing the chart to dictate optimal entry and exit points – as stops or trade adjustment levels. This strategy entails holding positions open for extended periods, sometimes days or weeks.

Our innovative indicator operates on the base volatility changes. While acknowledging the inherent unpredictability of financial markets, our indicator has demonstrated remarkable efficacy, boasting a 68% or higher predictive accuracy rate by highlighting crucial price turning points at the start or continuation of a price move.

The NeverLossTrading SwingPower uses a dynamic entry, exit, and stop definition to increase your trading accuracy.

NLT SwingPower Indication

The versatility of SwingPower extends across all asset classes, including stocks, options, futures, and FOREX. Recognizing that asset prices seldom follow linear trajectories, this indicator serves as a reliable tool for pinpointing crucial transition points where market dynamics shift from buyer to seller dominance and vice versa.

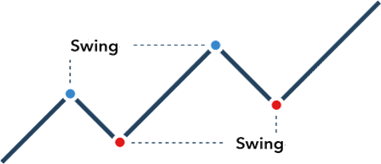

How can this be expressed on a chart?

Distinguished by its adaptability, the NLT SwingPower Indicator dynamically adjusts to prevailing market conditions, tailoring itself to the specific timeframe and asset under observation. It signals potential directional price changes when momentum shifts and preceding volatility occurs. On price charts, lime-colored signals serve as clear directives, indicating optimal entry points, earliest exit opportunities, and projected price movements from entry. These signals manifest at critical price junctures where buyer dominance transitions to seller dominance and vice versa.

NLT SwingPower Indications

Buy Signal |

|

|

|

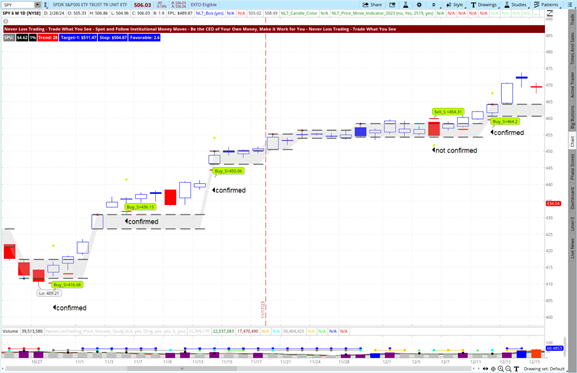

The following example shows five potential trade situations: four confirmed and came to target, and one not confirmed for the time of October 2023 to December 2023.

SPY, NLT SwingPower Example

The versatility of the NLT SwingPower Indicator is evident as it seamlessly integrates with other NLT Systems across various timeframes. However, its design was specifically tailored to excel in capturing swing trading positions, particularly on daily and weekly charts.

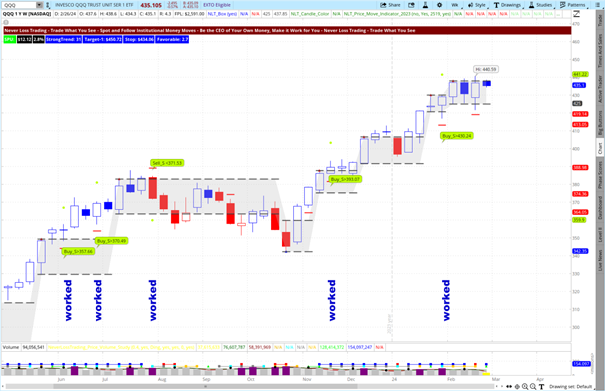

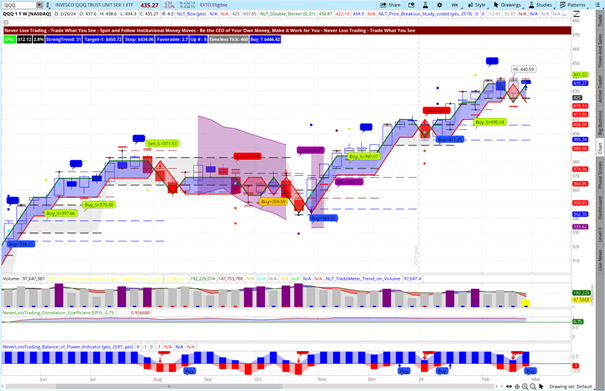

A compelling illustration of its efficacy unfolds in the weekly chart of QQQ (the ETF tracking the NASDAQ 100 Index) spanning from May 2023 to February 2024. Within this timeframe, five distinct trading opportunities emerged, each meticulously identified and confirmed by the indicator. Notably, all trades reached their pre-defined targets, represented by dots on the chart.

Examining the outcomes, the highlighted price moves yielded an average return on cash of approximately 3%. Furthermore, the average duration of each trade ranged from one to three candles, corresponding to one to three weeks in this instance. These statistics underscore the indicator's capacity to deliver favorable results within a relatively short timeframe consistently.

QQQ, NLT Weekly SwingPower Example

Five opportunities worked out most recently, but we are never 100% – but offer high probability trading!

Trades will be closed at the pre-defined price-move or after the maximum number of ten candles in the trade: A two-dimensional positive exit strategy.

To demonstrate how the systems supplement each other, we take the same period and combine NLT Top-Line and NLT SwingPower signals on the chart.

QQQ, Weekly NLT Top-Line and SwingPower Combined

Here is the translation into action:

When you learn how to trade with the NLT Delta Force Options Trading Concept, you can leverage long and short trades, even out of your IRAs, where short-selling stock is not allowed.

For example, the TSLA stock is mostly HTB: hard to borrow, and by that, it only offers options and trading strategies to follow price moves to the downside. In our mentorship, you learn how to risk-limit your trades, leverage your potential income and act at crucial price tuning points.

TSLA, NLT SwingPower Example

Without a solid options trading concept, you would have missed out on one of three recent trading opportunities.

Let us find a couple more examples and make visible what we worked out to support our clients:

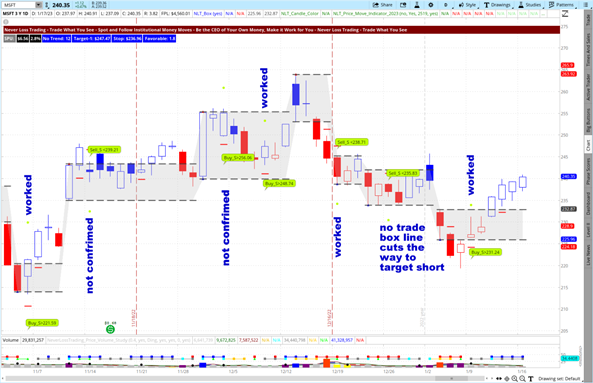

MSFT, NLT SwingPower Example

The MSFT chart showcases multiple distinct trading opportunities, each presenting a unique scenario for potential profit. Remarkably, those confirmed in the observed period successfully reached the system-defined target, as denoted by the lime-colored dots on the chart. Nevertheless, in certain instances, the anticipated price threshold was not attained during the subsequent candle's price movement, or the target was prematurely truncated by an NLT Box Line, resulting in unrealized trade potential.

Now, envision a scenario where an options trading strategy is employed, eschewing traditional stop-loss mechanisms in favor of a clear directional expectation over the next ten candles. In this context, all four opportunities would have materialized into profitable outcomes, reinforcing our assertion of high-probability trading.

To illustrate, consider situation 2: Rather than shorting the stock on December 19, 2022, one could have purchased Put options, anticipating a downward movement. The expected outcome aligned with the observed trend by holding this position for a maximum of ten candles or until reaching the trade target. Indeed, the target was met on December 22, 2022, validating the efficacy of this options trading strategy.

This concept is particularly potent when applied to assets boasting a robust options chain, facilitating enhanced flexibility and strategic maneuverability. By leveraging options contracts, traders can capitalize on market movements with precision and agility, minimizing risk while maximizing profit potential, supported by:

- Tight bid-ask spreads

- Solid volume for easy fill on opening and closing position

- High open interest for easy order execution

- Weekly options

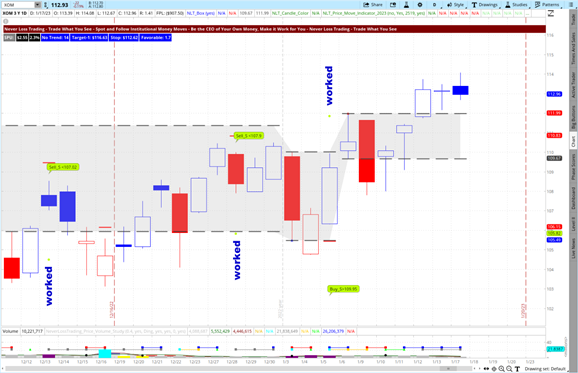

XOM NLT SwingPower Example

The NLT Delta Force Concept offers a streamlined approach to options trading, characterized by the following:

- clear entry conditions

- precise strike price selection

- strategic decisions regarding time to expiration

- concrete exit strategy

- maximum price to pay for an option or minimum premium to receive

By adhering to these specific parameters, traders can position themselves to capitalize on highly predictable trade setups, thus optimizing the risk-reward ratio and maximizing profit potential.

Success in the financial markets hinges on executing trades based on robust and dependable methodologies. We aim to empower traders with the tools and knowledge to identify and act upon such lucrative opportunities.

It's worth noting that the NLT SwingPower Indicator is exclusively available in conjunction with an NLT System or TradeColors.com. This intentional pairing ensures traders have ample time and training to acclimate to our systems and market approach. In the examples provided, we integrated the indicator with TradeColors.com, our introductory program to algorithmic trading, and NLT Top-Line price chart indications.

The NLT SwingPower Indicator is a profound tool for deciding daily and weekly trading opportunities. It is fully integrated into our suite of price move indications we report by the NLT Alerts.

NLT SwingPower Alert Example

![]()

Two out of four selected stock trades had NLT SwingPower signals.

Through the NeverLossTrading concepts and educational resources, we aim to streamline trading decisions and facilitate high-probability trading outcomes. By leveraging our systems and methodologies, we empower traders to confidently navigate the complexities of the market, relying on mechanical rules rather than subjective guesswork. We aim to provide traders with the tools and knowledge to unlock consistent market success.

contact@NeverLossTrading.com Subj.: NLT SwingPower Demo

Trade Rules:

-

Exiting at a pre-defined target prevents the price from pulling back and takes your profits away before you realize them.

-

Choose an adequate stop so you are not taken out of a trade by a too-tight stop and keep reward and risk in a meaningful balance.

-

Thus, we help you spell out potential price move setups with clearly defined trading rules.

-

With the help of the NLT Delta Force Concept, you are not even operating with a stop.

You let the chart tell when to buy or sell:

-

Entry Conditions: Execute buy-stop or sell-stop orders at pre-defined price thresholds

-

Exit Condition: When is the target reached

-

Stop Condition: When are you wrong and exit

The NLT SwingPower indicator leverages changes in volatility and integrates them with actual price action to anticipate the next move of the observed asset. This newly developed indicator identifies price shifts indicative of buyer or seller dominance, issuing a signal contingent upon confirmation in the subsequent price continuation candle: Buy > or Sell <. In instances of unclear direction, no signal is generated.

This systematic approach governs trading decisions by clearly defined rules, eschewing guesswork.

What is your take away:

-

By a change in volatility/vibration, we specify indications to act on high probability price turning points, applying mechanical rules rather than leaving room for interpretation.

-

The NLT system defines the minimum price movement based on an SPU analysis (Speed Unit), indicating how far a price move shall reach until it ends.

-

Operate with conditional buy-stop and sell-stop orders, ensuring that other market participants have the same directional assumption that your system spells out.

Let us know if you want a PDF write-up on the NLT Swing Power concept, and we will send it to you:

contact@NeverLossTrading.com Subj.: SwingPower PDF

*) Disclaimer

The risk of trading securities, options, futures can be substantial. Customers must consider all relevant risk factors, including their own personal financial situation before trading. In our teaching of how to trade the markets, in our newsletters, webinars and our involvement in the Investment Clubs, neither NOBEL Living, LLC, the parent company of Never Loss Trading and TradeColors.com, or any of the speakers, staff or members act as stockbrokers, broker dealers, or registered investment advisers: We worked out trading concepts and share them through education and services with our members and clients. Please also consider that past performance cannot be taken indicative for future results.

US Stock Market Holiday Schedule:

US Stock Market Holiday Schedule: