Why you want a High Probability Trading System

Without a reliable system, which constantly gives you clearly defined entries, exits, stops, and odds evaluations, trading success is rather random and mostly inexistent.

Our general rule: The private investor best finds a trading system, which give >63% probability for a trade setup to conclude in the assumed direction.

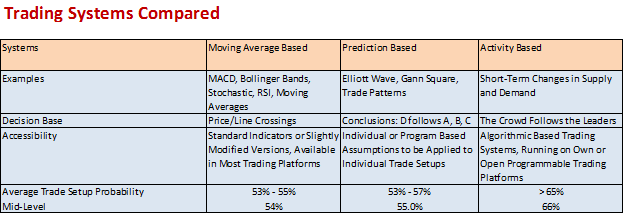

In general, we find three types of trading systems and compare them based on measured probabilities for success, resulting in an average expected return rate.

Moving Average Based Systems take their trade entry comparing longer- and shorter-term price happenings from the past and initiate an entry when the longer- and shorter-term component of the observation are crossing.

Prediction Based Systems assume that price patterns repeat themselves and thus allow the trader/investor to follow them, reaching from candle stick patterns to cup-and-handle.

Activity Based Trading Systems analyze short-term changes in supply and demand patterns, indicating the setup of a potential directional price move. So far there are only a few of those available to you a private investor.

Aside from the return expectation, the average costs of a trading system are a key consideration for you as a private investor.

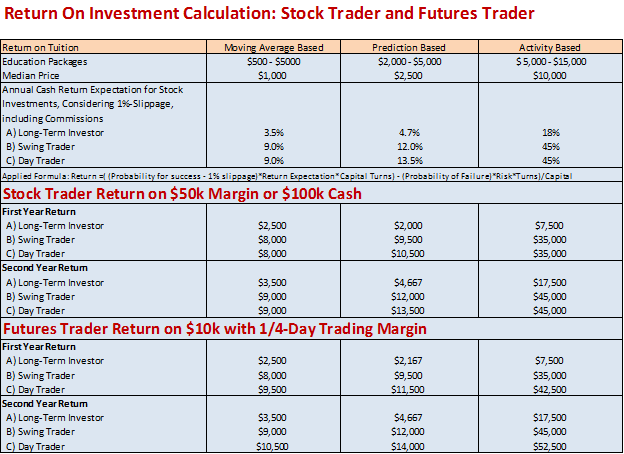

Let us compare those based on two type traders:

Type-1: A stock trader using $50k with margin or $100k in cash.

Type-2: A Futures Trader, using $10,000 in cash, applying one-quarter of day margin.

The first year calculation includes the recuperation of the initial tuition costs.

Both cases show: Activity based trading systems; even so they ask for a higher initial investment, produce returns far beyond moving average- or prediction based systems.

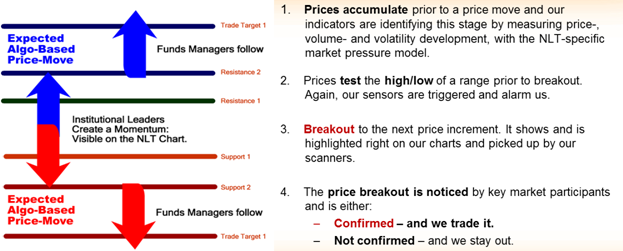

Let us take the NeverLossTrading Top-Line System as an example for an activity based high probability system.

The system spots changes in supply and demand, initiated by institutional leaders, mostly Prop Traders. At the instance, when other market participants recognize their engagement and jump on the band wagon, the NLT Top-Line User trades with a defined entry-price-threshold, a defined target, and stop; always considering that the odds remain in favor of the trader.

Market makers are the key gate keepers; they immediately recognize and react on changes in supply or demand, conducting a price change, often combined with a volume change. This triggers the potential trade alert when it is acknowledged, you enter into a trade considering:

NeverLossTrading Supply and Demand Model Base

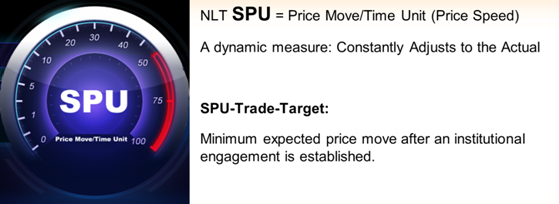

NLT uses dynamic algorithms to predict expected price moves and formulate those targets in Speed Units: SPU

NLT SPU or Speed Unit

Even so historic performance cannot be taken indicative for future results, this system produces trade setups in excess of the required 66%. When subscribing to a mentorship, you will learn in 20-hours of initial training and a six month mentorship how to execute a business plan for trading that is tailor made to your wants and needs.

Every trader brings a different risk tolerance and affinity to assets and trade environments. Hence, one system does not fit all. This is why NeverLossTrading teaches in individual lessons, producing the system and trade focus together with you, helping you to turn yourself into the trader, you want to be.

Trades do only get initiated if the on-the-chart-formulated-minimum-price-threshold is surpassed in the following candle or candles: Depending on the trading method you choose. Buy > $100.50 means that a trade will only get initiated when the price of the asset moves at least to $100.51. This method is applicable to Stocks, their Options, Futures and Forex.

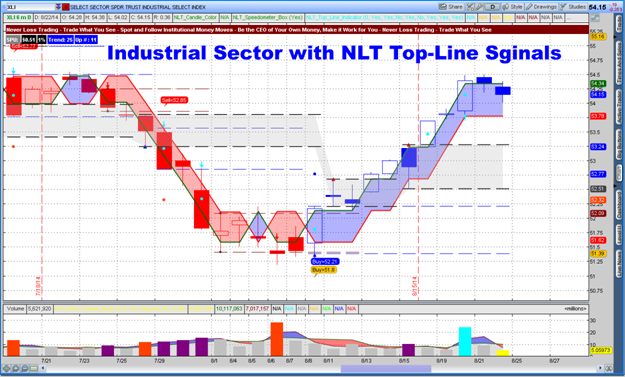

Swing Trading Example, Industrial Sector ETF Trade on the NLT Top-Line Chart

What you see on the chart:

Red covered trade environments favor short selling opportunities. Blue environments indicate strength and prefer long trades.

Institutional engagement is also indicated by colored volume bars and cyan dot highlighted NLT Light Tower Candles.

See the following example for even more details:

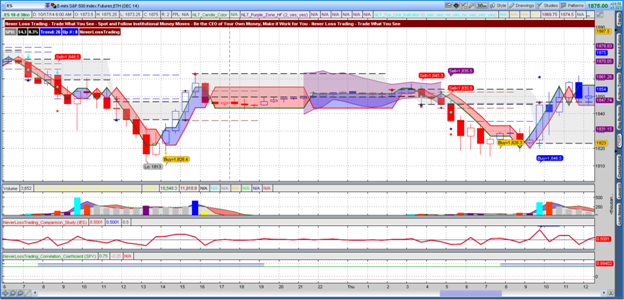

Day Trading Example: E-mini S&P 500 Index Futures on the 30 Minute Chart

On the chart above, five trades got initiated with four wins (80%) and one loss (second yellow signal, the stop of the trade got reached).

If you want to experience how NeverLossTrading systems work real time, schedule a private consulting hour by: Call +1 866 455 4520 or contact@NeverLossTrading.com

We are looking forward to hearing back from you,

Thomas

NeverLossTrading

Disclaimer

The risk of trading securities, options, futures can be substantial. Customers must consider all relevant risk factors, including their own personal financial situation before trading. In our teaching of how to trade the markets, in our newsletters, webinars and our involvement in the Investment Clubs, neither NOBEL Living, LLC, the parent company of Never Loss Trading, or any of the speakers, staff or members act as stockbrokers, broker dealers, or registered investment advisers. We worked out trading concepts that benefit us greatly and share them through education with our members and clients.

US Stock Market Holiday Schedule:

US Stock Market Holiday Schedule: